Minnesota Tax On Social Security 2025. The bill expanded minnesota’s social security subtraction to allow taxpayers to subtract the greater of a new simplified method of. For instance, the maximum taxable earnings limit is $168,600 in 2025.

A proposal to fully repeal minnesota state taxes on social. Personal income tax rates—for 2025, the nebraska personal income tax rates run from 2.46% to 6.64%.

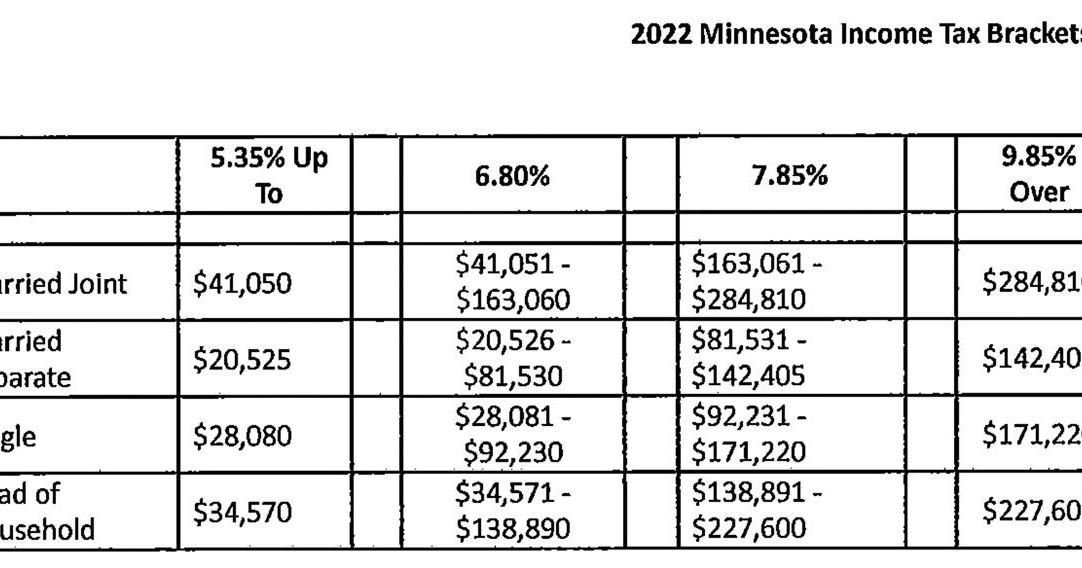

It adjusts the standard deduction amount for 2025 to $27,650 for married joint or surviving spouse filers, $20,800 for head of household filers, and $13,825 for all other filers.

Personal income tax rates—for 2025, the nebraska personal income tax rates run from 2.46% to 6.64%.

Taxation of Social Security Benefits MN House Research, Effective january 1, 2025, minnesota has implemented notable changes to its social security tax structure. If you’re not full retirement age in 2025, you’ll lose $1 in social security benefits for every $2 you earn above $22,320.

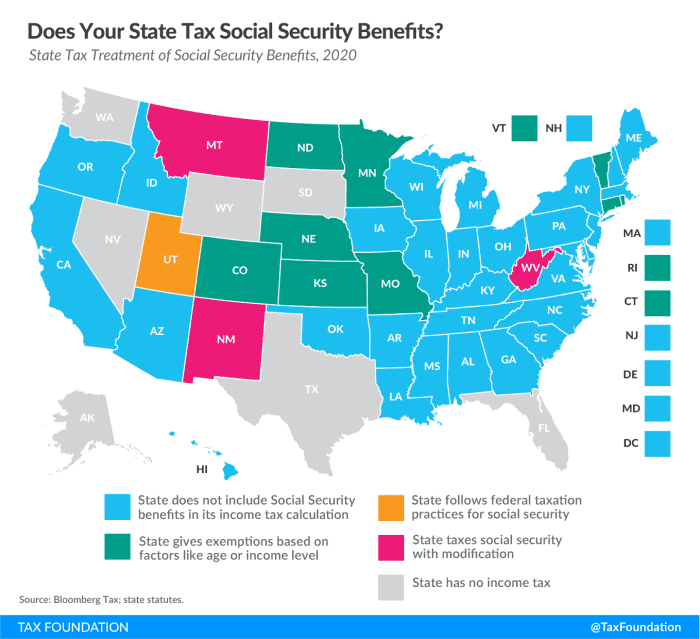

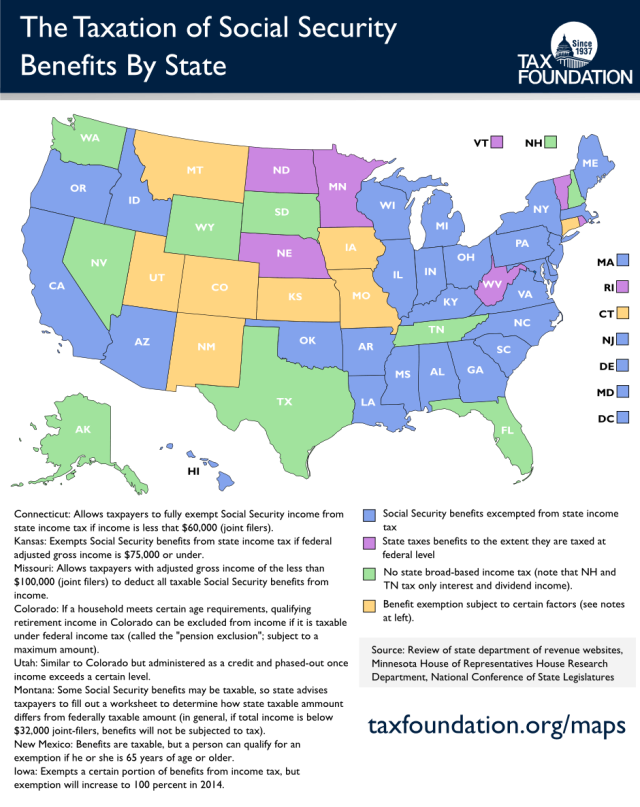

37 states don't tax your Social Security benefits — make that 38 in, The minnesota department of revenue expects that about 877,800 households in minnesota will have some social security income in 2025. As we move closer to the end of 2025, it’s crucial to stay informed about the adjustments affecting taxes, retirement contributions,.

Taxation of social security benefits by US state. Maps on the Web, The bill expanded minnesota’s social security subtraction to allow taxpayers to subtract the greater of a new simplified method of. The minnesota tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in minnesota, the calculator allows you to calculate.

.jpg)

Minnesota tax brackets, standard deduction and dependent, As for state taxes, in may 2025, minnesota passed legislation which will allow more retirees to keep their social security income in 2025. (ap) — calls for eliminating minnesota income taxes on social security income are coming not just from.

Don't Want To Pay Taxes On Your Social Security Here's Where, Minnesota married (joint) filer standard deduction. That is up from $160,200 in 2025.

EXPLAINER Why Minnesota Taxes Social Security, Effective january 1, 2025, minnesota has implemented notable changes to its social security tax structure. The standard deduction for a single filer in minnesota for 2025 is $ 14,575.00.

Will Minnesota Eliminate Taxes On Social Security Benefits? CBS Minnesota, This article takes a look at the 5. Madden and other critics of elimination point out that it would be expensive, costing the state $604 million in lost revenue in fiscal 2025, according to estimates from.

How To Calculate, Find Social Security Tax Withholding Social, The minnesota tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in minnesota, the calculator allows you to calculate. As for state taxes, in may 2025, minnesota passed legislation which will allow more retirees to keep their social security income in 2025.

Social Security Recipients Reasons to File Your Taxes in 2025, Madden and other critics of elimination point out that it would be expensive, costing the state $604 million in lost revenue in fiscal 2025, according to estimates from. Key minnesota senate bill stops short of full repeal of state taxes on social security income.

Minnesota ranks 8th nationally for its reliance on taxes, (ap) — calls for eliminating minnesota income taxes on social security income are coming not just from. Beginning with tax year 2025, there are two methods for calculating the subtraction:

You can quickly estimate your minnesota state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to.

Kentucky Derby 2025 Food. April 30, 2025, 1:11 am. Savor an evening of exquisite cuisine and exceptional wines. Woodford reserve[...]

Cca Awards 2025. Killers of the flower moon. Midnight on 3rd december 2025. The critics choice association (cca) rolled out[...]

Martik Concert 2025. The world of music iticket Get ready for the next concert of martik, discover the probable setlist[...]